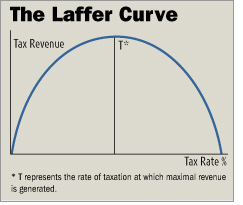

The theory is really one of the simplest concepts in economics. Yet its logic continues to elude the class-warfare lobby whose disbelief is unburdened by the multiple real-life examples which validate its conclusions. The idea is that lowering the tax rate on production, work, investment, and risk-taking will spur more of these activities and thereby will often lead to more tax revenue collections for the government rather than less....

Last week the Congressional Budget Office released its latest report on tax revenue collections. The numbers are an eye-popping vindication of the Laffer Curve and the Bush tax cut's real economic value. Federal tax revenues have surged in the first eight months of this fiscal year by $187 billion. This represents a 15.4% rise in federal tax receipts over 2004. Individual and corporate income tax receipts have exploded like a cap let off a geyser, up 30% in the two years since the tax cut. Once again, tax rate cuts have created a virtuous chain reaction of higher economic growth, more jobs, higher corporate profits, and finally more tax receipts.

This Laffer Curve effect has also created a revenue windfall for states and cities. As the economic expansion has plowed forward, and in some regions of the country accelerated, state tax receipts have climbed 7.5% this year already.... New York City... finds itself more than $3 billion IN SURPLUS....

没有评论:

发表评论